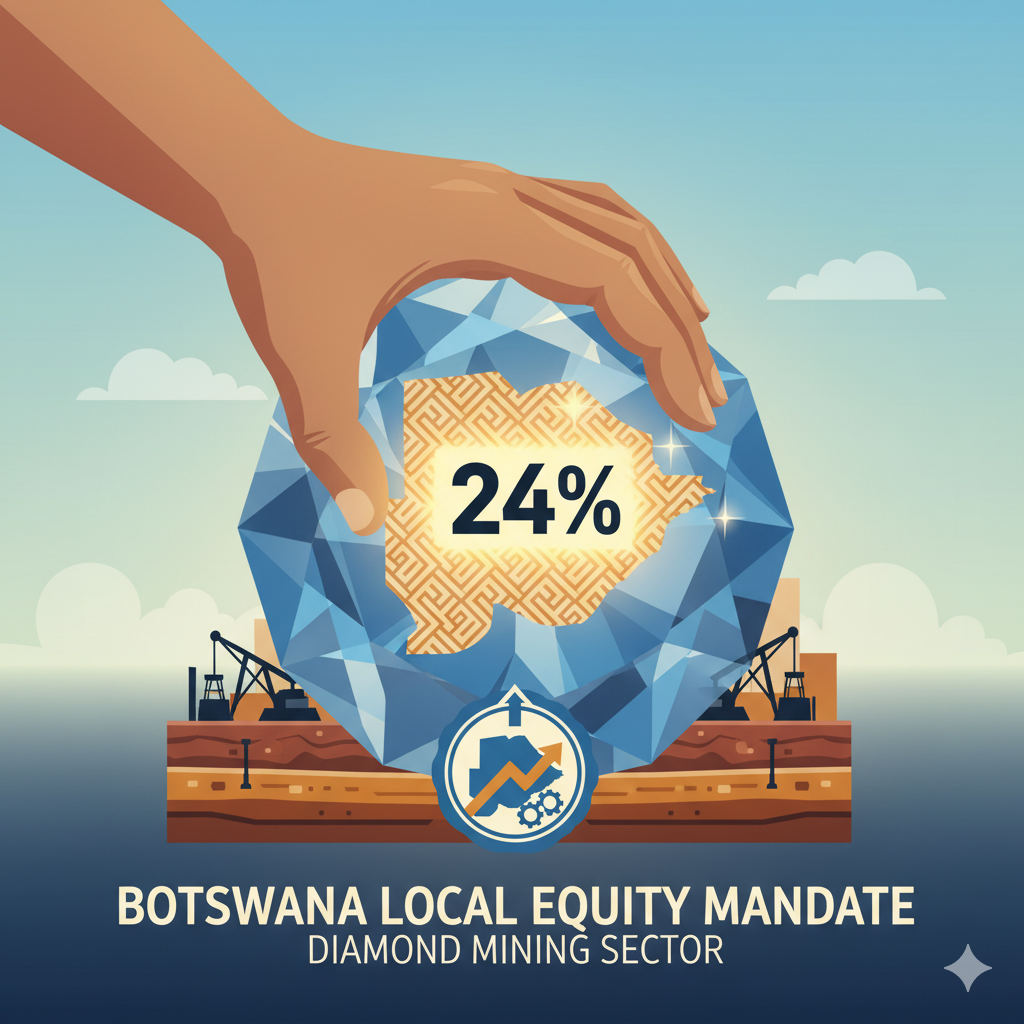

The Geopolitics of Gemstones: Analyzing Botswana’s 24% Local Equity Mandate as a Strategy for Economic Sovereignty and Resilience

Strategic Policy

Botswana, the world’s leading diamond producer by value, has enacted a fundamental overhaul of its Mines and Minerals Act, effective October 1, 2025, introducing a mandatory 24% local equity participation requirement in all new mining concessions. This policy represents a decisive shift from traditional, State-negotiated partnerships to a mandated framework for citizen ownership. The regulatory initiative is a direct response to a severe fiscal crisis, primarily driven by the prolonged global diamond downturn, characterized by oversupply and the rapidly accelerating market penetration of lab-grown diamonds (LGDs).

The amendment is designed to achieve three core strategic objectives: strengthening domestic ownership of mineral wealth, enforcing local value-adding activities (beneficiation) within Botswana, and mandating pre-funded environmental rehabilitation guarantees from mining firms. A key innovation supporting this mandate is the mobilization of domestic institutional capital, specifically pension funds, which have been encouraged through complementary legislation to reduce offshore holdings and finance the acquisition of the 24% local stake.

For Foreign Direct Investors (FDI), this legislation necessitates a fundamental restructuring of project governance, financial projections, and environmental liability planning. While the policy signals an increase in regulatory risk—raising the overall cost of compliance—Botswana’s approach avoids the pitfalls of punitive, non-financed nationalization models seen in other jurisdictions. Instead, it positions Botswana at the forefront of sophisticated resource governance, forcing partners to align their investment models with the national imperative of maximizing in-country value capture and long-term economic resilience.

I. Botswana’s Diamond Dependency Crisis and the Impetus for Policy Reform

A. The Foundations of Prosperity: The De Beers Partnership (1966–2023)

Botswana’s remarkable economic trajectory since gaining independence in 1966 is widely celebrated as an African success story, fundamentally underpinned by its stable, long-standing partnership with the De Beers Group. This collaborative model, centered around the Debswana 50:50 Joint Venture, provided decades of predictable revenue streams that allowed the nation to invest significantly in infrastructure, healthcare, and education, transforming it into a middle-income country. Despite the success, this reliance forged an immense structural dependence on a single commodity, creating significant vulnerability when global market conditions deteriorated.

B. Indicators of Structural Economic Vulnerability (2024–2025 Fiscal Shock)

The deep concentration of economic activity in the diamond sector became a major fiscal liability during the recent market slump. Diamonds constitute approximately 80% of Botswana’s export earnings, 30% of its Gross Domestic Product (GDP), and roughly 30% of government revenue. The global downturn confirmed the fragility of this economic structure. In 2024, Botswana’s economy contracted by 3%. This contraction was directly attributed to reduced output and sales by Debswana, which fell by almost 50%. Consequently, government diamond revenues plummeted by 50% in 2024. The fiscal shock has led to a widening budget deficit, reportedly reaching 9% of GDP, and necessitated heavy reliance on drawing down foreign reserves. The International Monetary Fund (IMF) projected continued hardship, forecasting a further GDP contraction of 0.4% in 2025.

C. The Global Diamond Market Shock: The Existential Threat of Synthetics

The economic pressure on Botswana is being intensified by two primary global factors: oversupply and the existential threat posed by lab-grown diamonds (LGDs). Global demand for natural diamonds has waned, leading to high inventory levels and a price decline of nearly 20% during 2023, forcing major producers like De Beers to reduce supply.

However, the more profound structural challenge is the rapid market penetration of LGDs. These stones offer similar visual quality at significantly lower prices, disrupting the perception of natural diamonds as a unique store of value. Consumer behavior, particularly within the 25-35 age demographic, has shifted dramatically, with LGDs accounting for nearly 50% of the US engagement ring market by volume in 2024—a tenfold increase from 2019.

The natural diamond industry has responded by repositioning natural stones through marketing campaigns emphasizing rarity, age, and legacy. Nevertheless, the widespread acceptance of LGDs has choked off Botswana’s historically reliable revenue streams, lending urgency to the nation’s push for greater control over value capture and economic diversification. The immediate economic crisis provided the political necessity and leverage required to implement aggressive, long-sought policy goals, such as mandatory increased local ownership and greater sovereign control over mining ventures. The new mandate thus serves as regulatory reinforcement for President Boko’s vision of economic sovereignty.0

II. Architecture of the Mines and Minerals Act Amendment (2025)

A. The New Local Equity Threshold: Mandatory Citizen Participation

The recently enacted Mines and Minerals Act amendment, implemented on October 1, 2025, mandates a significant increase in local participation requirements. The law stipulates that mining companies seeking new concessions must reserve a 24% equity stake for local investors. This new threshold represents a substantial enhancement of the government’s ability to secure national benefit compared to the previous Mines and Minerals Act, which allowed the government only a 15% shareholding option in mining concessions.2The policy applies specifically to all new mining licenses granted after the effective date.

B. Dual Pathway to Participation: State versus Citizen-Owned Companies

The structure of the 24% requirement provides a dual mechanism for securing national participation. First, the government retains the right of first refusal to purchase the entire 24% stake. However, if the government opts not to acquire this share, the stake must then be allocated to qualified local investors or citizen-owned companies. This structural detail is crucial because it broadens participation beyond the state-owned Minerals Development Company Botswana (MDCB), directly empowering the domestic private sector and potentially distributing mineral wealth benefits more widely across the population.

C. Core Objectives Embedded in the Legislation

Beyond securing increased equity, the legislation formalizes three critical policy mandates designed to maximize in-country value retention and long-term sustainability:

- Local Ownership and Value-Adding: The policy aims explicitly to increase local ownership and simultaneously promote local value-adding activities.1 This is reinforced by a new requirement that mineral concession holders must beneficiate minerals within Botswana “where feasible” Applicants are consequently required to detail comprehensive plans for local value-adding activities in their project proposals.

- Environmental Liability and Reclamation: The amendment mandates that mining companies create dedicated funds for environmental rehabilitation. This ensures that the costs associated with post-operation clean-up and closure are provisioned for throughout the mine’s lifecycle.

- Governance Reinforcement: The Act includes provisions for increased penalties for illegal mining and non-compliance, signaling a lower governmental tolerance for regulatory lapses.

D. Policy Implications for Foreign Investors

The transition from a 15% government option to a 24% mandatory local inclusion places a significantly greater compliance and structural burden on Foreign Direct Investment partners. Multinational Corporations (MNCs) are now obligated to proactively develop local partnership strategies, rather than relying solely on negotiation with the State. Crucially, mining applications must now transparently disclose the source of the 24% local capital. By making the capital source a mandatory disclosure element, the government effectively guides the investment dynamics toward domestic institutional investors, while simultaneously externalizing the complexity of local empowerment to the MNCs.

Furthermore, while the immediate impetus for the policy stems from the crisis in the diamond sector, the 24% rule applies to all new concessions. Botswana is actively developing into a rising copper mining hub. Applying this robust governance model across all mineral sectors, including copper and nickel, signals the government’s firm intent to generalize this national interest paradigm throughout its diversifying extractive industry.

III. Financing Sovereignty: The Role of Pension Funds and Capital Repatriation

A. Addressing the Capital Challenge: Institutional Investment

A persistent challenge for resource nationalism policies across Africa is addressing the immense capital intensity of mining investment. Botswana addresses this by mobilizing its domestic institutional funds. Government officials have confirmed that local investors can acquire the 24% stakes in concessions with the assistance of domestic pension funds.

This “pension fund model” represents a deliberate strategy to achieve broad citizen participation institutionally. Instead of imposing a free-carry obligation on foreign operators, or limiting ownership to a small elite capable of direct share purchases, the policy integrates the mining sector directly into the long-term wealth creation mechanisms for the entire citizenry via their retirement savings.

B. Regulatory Support: Mandatory Domestic Reallocation of Assets

To ensure that sufficient capital is available in Pula currency to finance the 24% mandate, the government implemented a complementary law change in the preceding year. This law required domestic pension funds to reduce their offshore investment ceiling from 65% to 50% over a three-year timeframe.

This policy adjustment repatriates a substantial volume of investment capital, creating a dedicated pool of domestic funds specifically available for local investment opportunities, including critical mining sector participation. This centralized policy effort solves the historic “capital gap” often associated with resource equity mandates by coordinating financial regulation with mineral policy.

C. Analysis of Financial and Systemic Risk

The utilization of domestic pension funds for equity acquisition is an innovative, yet highly calculated, policy choice. While it provides the necessary financing backbone for the mandate, it simultaneously introduces an element of systemic risk to the nation’s retirement security. The success of the investment depends directly on the long-term profitability and stability of these new mining ventures. A failure in a major concession would mean that the loss is borne directly by Batswana’s retirement savings.

The policy’s success is thus contingent upon two key factors: first, the regulatory stability offered by the government, and second, the valuation methodology applied to the 24% stake acquisition. The process must ensure the purchase is conducted at fair market value to safeguard citizen assets and maintain the confidence of foreign investors. If the valuation mechanism is transparent and defensible, it preserves Botswana’s reputation for fiscal prudence and lowers the perceived political risk associated with the policy.