Diamond Standard is the producer of an exchange traded, regulated diamond commodity. Equivalent to a standard gold bar for the diamond market, the diamond coin and bar enable investors to access an estimated $1.2 trillion asset class for the first time.

Meet Diamond Standard: A New Way to Value Natural Diamonds

Learn about a brand new asset class that looks to homogenize diamonds into a tradable asset. Diamond Price Calculator

Introducing NDC’s New Partner: Diamond Standard

Deep underground, the tectonic plates that make up the surface of our world float on a churning sea of magma: Earth’s molten core. There, in the Mantle, is where diamonds were formed. The process takes millions of years, intense pressure, and heat to produce crystals of remarkably ordered carbon atoms. They only come close to the Earth’s surface through specific types of volcanic eruptions.

They are exceptionally hard, exceptionally beautiful, exceptionally rare, and each one is different. These qualities make natural diamonds so nice to look at and even nicer to wear.

Figuring out their value, though, can be daunting and is typically carried out by a handful of highly educated and connected groups around the world. In other words, if you asked 5 different people how much a diamond is worth you could get 5 different answers.

The Diamond Standard – a brand new asset class that looks to homogenize diamonds into a tradable asset – might just be the one answer we’ve been looking for.

Unlike gold or silver, which are elements and have a constant purity grade, diamonds are one of the many forms of carbon, and to a certain extent valued in the eye of the beholder. An expert eye has been required. “There’s both an art and a science to valuing diamonds. You can look at the trade metrics, and there’s a robust market from dealer to dealer,” explains Greg Kwiat, CEO and 4th generation proprietor of Kwiat Diamonds. “Then, of course, we understand the retail market. We look at every stone for its four C’s [the color, clarity, carat weight, and cut] and we apply that knowledge to valuing each diamond. Then there are all the intangibles, the beauty of the stone, the rarity of the stone. Each diamond really is individual when we look at it that way.”

These same nuances that have made diamonds so appealing for centuries have ironically prevented them from becoming an asset class like other valuable and rare materials. When asked if he considered diamonds a liquid asset, noted market expert Paul Zimnisky says, “No, given that there are somewhere around 10,000 different categories of diamonds, trading of diamonds tends to be more difficult than that of fungible assets like gold or shares of a company, i.e. stock. Certain expertise is required to trade diamonds at an efficient level. The total transaction costs, or ‘trading friction’ tends to be high.”

To create a fungible, standardized asset out of natural diamonds has been considered too complicated to be worth attempting. You would need a rocket scientist to figure it out or a quant – the quantitative analysts who are pretty much financial rocket scientists. Cormac Kinney is a highly accomplished quant, and maybe the only one married to a highly regarded jewelry designer. Cormac believed diamonds could do more for their owner than just bring joy. “They’re an asset, like gold, silver, and platinum. But because every diamond is different, an investor could never trade them,” says Cormac. “They could never have price transparency or liquidity. And what I believed and later proved was that it was a computer science problem that we could solve.”

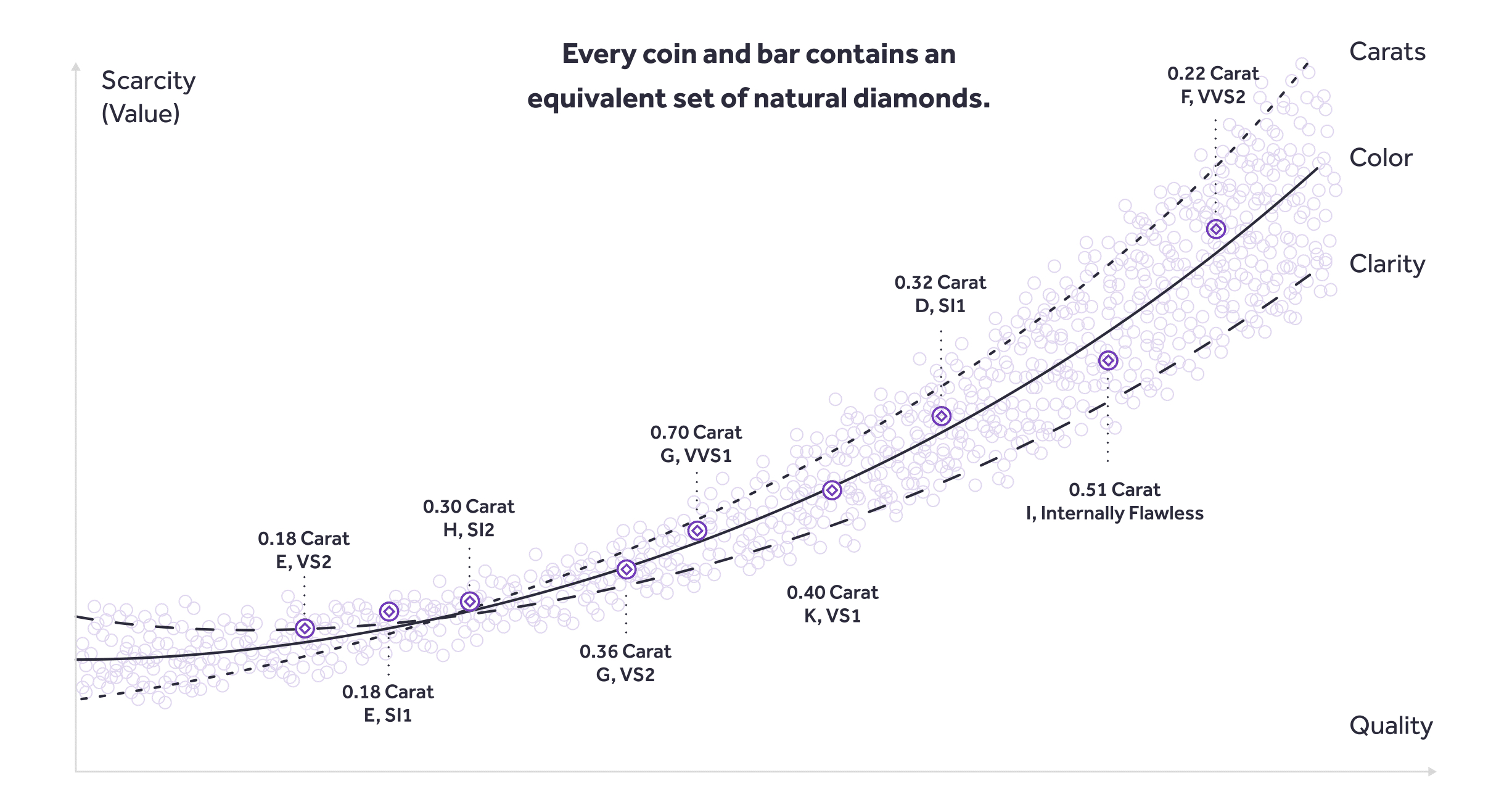

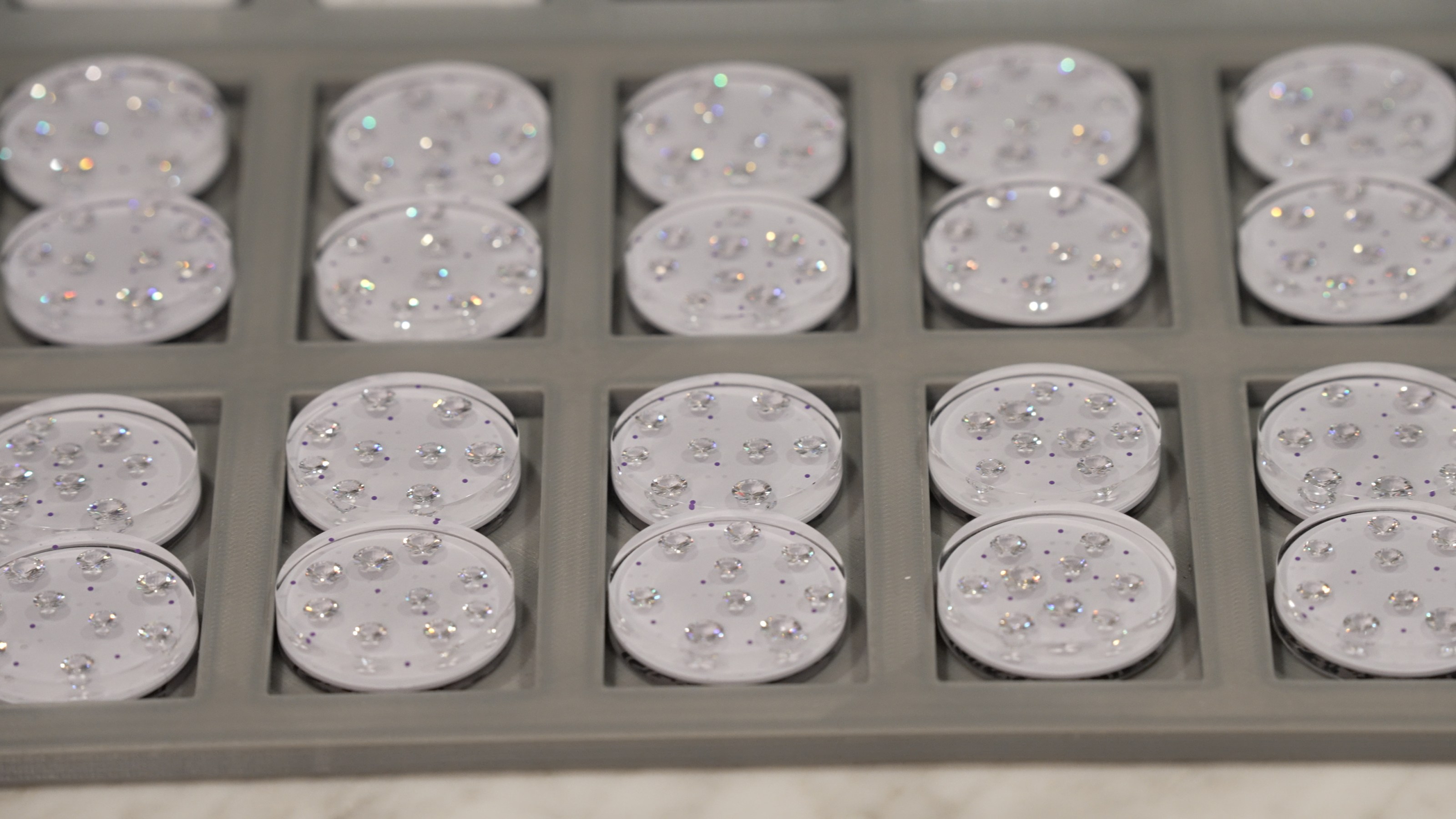

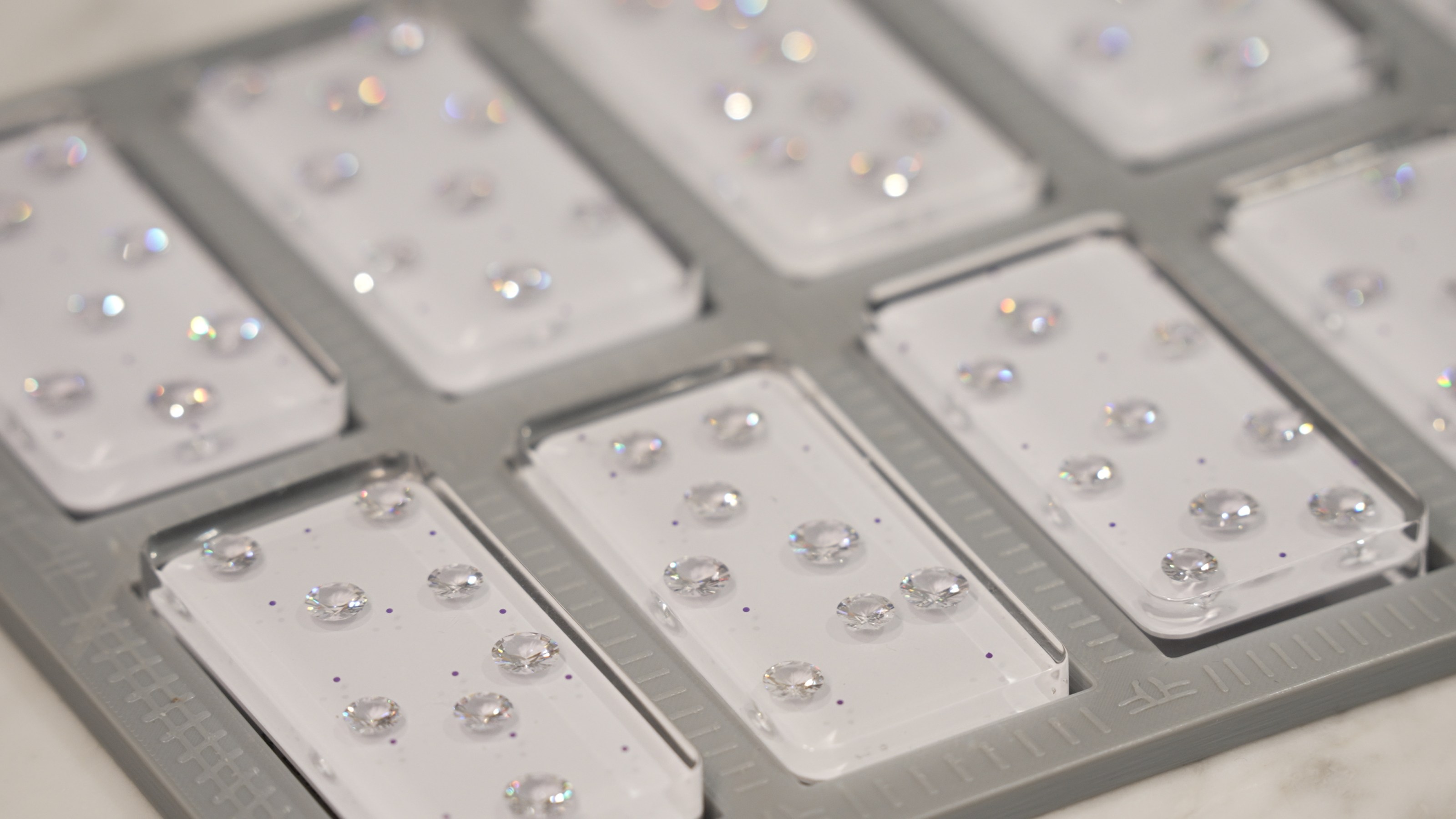

The fruit of Cormac’s labor is the Diamond Standard – the world’s first and only regulator-certified Natural Diamond Asset and marketplace. Groups of diamonds are brought together into coins and bars that are tracible, fungible, and of equal value to create an asset class that is tradable and therefore liquid. “The process for creating the diamond standard commodities is actually very interesting. And it’s several computer science breakthroughs,” explains Cormac. “The first point is that we have no opinion on what the values of individual diamonds are. We force the market to tell us what they’re worth by using automated market making. What that means is we bid on millions of different types of diamonds every day, all around the world. Our job is to buy a statistical sample of all diamonds, and we make that sample public. That way we can prove that we did our job, which has forced price discovery and buy a little bit of every different type of carat weight, color, and clarity of diamonds in order to optimize them to make every bar and coin identical.”

The process is largely automated, to further take the guesswork out of assembling the bars and coins. Each diamond is traced and each coin and bar has its own unique blockchain token embedded into the clear plastic casing for tracing and auditing purposes.

Creating new asset classes is tricky, and there has been an implosion in web3 asset market this year. The 2008 financial crisis was triggered by the trading of mortgage-backed securities and their esoteric (and unregulated) credit default swap derivatives. Diamond Standard offers an intriguing alternative, and one mined from the actual ground rather than Bitcoin, which is mined in a server farm using as much energy as a medium-sized city. Taking the pricing of diamonds out of the back rooms is critical to the success of the Diamond Standard.

“We had to create the diamond standard exchange, which is comprised of the 180 largest diamond vendors in the world. They list on average a million diamonds per week on our exchange. Every member has gone through a KYC [Know Your Customer] and AML [Anti-Money Laundering] process, meaning that we background check them. They’ve also signed agreements to adhere to the Kimberley Process [by which diamonds are certified as non-conflict]. So we’re providing governance and transparency,” shares Cormac. And the value of diamonds will likely only increase in the long term.

“Something that people are surprised to learn is that diamonds are running out. They haven’t discovered a new diamond mine in over 20 years. And so the supply has been diminishing between 3 and 5% per year. We don’t know when they’ll run out, but the supply is falling,” says Cormac. “At the same time, the demand for diamond jewelry has been rising, especially in countries like China. And so you have an interesting situation with falling supply and rising demand. And now for the first time ever, we have financial demand, where investors around the world are building a position in diamond for the very first time.”

With portfolio managers and bankers getting into the scene, what does this mean for the folks who just love and wear diamonds? Will they be priced out of the market? Paul Zimnisky is circumspect. “If [Diamond Standard] can turn diamonds into a mainstream investment product, then yes of course it would generate notable incremental demand for natural diamonds.” But Cormac is confident he’s baked in all the contingencies to the Diamond Standard model. “When we built our commodity, we designed it in a way that uses all of the varieties of gem quality diamonds that you find in your jewelry store, which means as we acquire them for investors, all diamonds will move at the same rate of change the price, for example. So we were very careful not to disrupt the jewelry world.”

“We’re also creating a different type of buyer, not one that’s emotional or so interested in the beauty. Our bars are beautiful, but they’re interested in the investment value, a store of wealth, a hedge against inflation, or something that can be a speculative investment that outperforms inflation. Those are the key drivers and a very new opportunity for a long-standing natural resource.”

Greg Kwiat agrees that all use cases for natural can co-exist and be mutually beneficial. “We have deep relationships with our customers. We want to make sure when they come into our store, they’re fully educated about our world,” he says. “One of the ways we can bring up the conversation of long-term value in diamonds is through an introduction of the Diamond Standard commodity. By explaining why this exists, and why it tells the story of long-term value for diamonds, it really gives us an opportunity to have a great conversation with our clients. I think that there are a lot of clients who are both interested in celebrating their milestones with jewelry and could also be interested in making investments into this type of asset. They are two halves of the same whole; they’re not going to cannibalize each other.”

Another thing to consider is that when it comes to the Diamond Standard bars and coins, the buyer has no choice as to the stones included in their asset. Each unique bar is chosen and assembled by computer model, and the physical assets are kept in a custom vault at a Brink’s facility in Delaware (no sales tax). You can, of course, have them at home for display purposes, or if you wanted to get the actual diamonds out. “We designed it so that you simply drop the coin in paint thinner, and overnight it melts and you end up with eight GIA-certified diamonds. You can make rings or earrings or anything you like, but this is not recommended,” says Cormac. Some investors have found more innovative uses. “The most interesting use of our coins and bars so far is that we made a custom set for a major casino in Macau for the high roller table, where they’re using actual diamond standard coins and bars as the poker chips.”

All this new activity could eventually make looking for undiscovered diamonds a more enticing prospect. “If diamond prices go up enough new diamond deposits will become economic for development which will then provide additional supply to the market. So there tends to be a cyclical nature to price and supply in this way,” says Zimnisky. While the odds of finding massive new diamond deposits are vanishingly slim, the world does keep turning, and looking would be the first step to finding.

Market Prices

Diamond prices are influenced by global trends. The largest markets are USA (about half), China and India. Since 2008, larger diamonds have appreciated better than smaller ones.

Price fluctuations

Polished diamond prices vary widely depending on a diamond’s carat, colour, clarity and cut, sometimes referred to as the 4 Cs. In contrast to precious metals, there is no universal world price per gram for diamonds. The industry refers to diamond price guides.

Rough diamond prices have historically been impacted by the mining companies controlling supply, most notably De Beers. However, after the dismantling of the De Beers cartel in 2001, the industry is now more fragmented resulting in a higher percentage of diamond sales taking place in the form of auctions and other forms of open-market sales.

Financial feasibility

Synthetic diamonds

Since the 1950s, techniques can produce gem-quality diamonds of essentially any desired chemistry in sizes up to about 1cm. [11] Although some manufacturers do label their synthetic diamonds with serial numbers there is no guarantee that a given diamond is not man made, although sometimes an unnatural chemical composition or pattern of flaws may suggest a diamond is synthetic. It is much cheaper to produce diamonds through artificial synthesis than to mine them,[12] although currently the cost of synthesis is still significant. The inability to guarantee that a diamond is naturally occurring could undermine the premium price still currently charged over synthetic diamonds.[13] However, new technological advances have allowed some independent gem labs such as GIA (Gemological Institute of America) to issue a specific Synthetic Diamond Grading Report which identifies a diamond as laboratory-grown and laser inscribes it with “laboratory grown”.[14]

Polished diamonds

There are several factors contributing to low liquidity of diamonds. One of the main factors is the lack of terminal market. Most commodities have terminal markets, and some form of commodities exchange, clearing house, and central storage facilities. Until recently[when?] this did not exist for diamonds.[citation needed] Diamonds are also subject to value added tax in the UK and EU, and sales tax in most other developed countries, therefore reducing their effectiveness as an investment medium. While most diamonds are sold through retail stores at high margin, investment diamonds are usually sold at auctions or privately.

Diamonds in larger sizes are rare, and their price is dependent on the individual features of the diamond. Fashion and marketing aspects can also cause fluctuations in price. This makes it difficult to establish a uniform and readily understood pricing system.[citation needed] Martin Rapaport produces the Rapaport Diamond Report, which lists prices for polished diamonds. The Rapaport Diamond Report is relatively expensive to subscribe to and, as such, is not readily available to consumers and investors. Each week, there are matrices of diamond prices for various shapes of brilliant cut diamonds, by colour and clarity within size bands. The price matrix for brilliant cuts alone exceeds 1,400 entries, and even this is achieved only by grouping some grades together. There are considerable price shifts near the edges of the size bands, so a 0.49 carats (98 mg) stone may list at $5,500 per carat = $2,695, while a 0.50 carats (100 mg) stone of similar quality lists at $7,500 per carat = $3,750. This difference seems surprising, but in reality stones near the top of a size band (or rarer fancy coloured varieties) tend to be uprated slightly. Some of the price jumps are related to marketing and consumer expectations. For example, a buyer expecting a 1 carat (200 mg) diamond solitaire engagement ring may be unwilling to accept a 0.99 carats (198 mg) diamond.[citation needed]

There are numerous diamond grading laboratories, with each offering investors, consumers and dealers similar diamond-grading and verification services, including the Gemological Institute of America (GIA) and the CIBJO (Confédération Internationale de la Bijouterie, Joaillerie et Orfèvrerie), also known as the World Jewellery Confederation.[citation needed] If the standards set by such organisations are called into question, ramifications are felt throughout the diamond industry.[citation needed] In 2005, the GIA was sued by a dealer who had supplied diamonds to the Saudi royal family after the accuracy of GIA-issued certificates was questioned.[15] As a result of a subsequent investigation, four GIA employees were fired for breach of the GIA’s ethical codes.[16] The GIA also claims to have changed some of its procedures to prevent such occurrences from happening again.

The non-linear pricing of different sizes (weights) of diamonds means that it is not realistic to exchange, for example, two quarter-carats (50 mg) for one half-carat (100 mg). With commodities such as gold, it is clear that one 20-gram bar is worth the same as two 10-gram bars, assuming the same purity. In most terminal markets, there needs to be a readily available standard quality, or limited number of qualities, available in sufficient quantity to be tradeable. This is a major factor which affects liquidity. The many variables in diamond quality makes commodity-like pricing difficult, especially with rarer stones that merit special handling above standard-issue diamonds.[citation needed]

The investment parameter of diamonds is their high value per unit weight, which makes them easy to store and transport. A high-quality diamond weighing as little as 2 or 3 grams could be worth as much as 100 kilos of gold. This extremely condensed value and portability does bestow diamonds as a form of emergency funding. People and populations displaced by war or extreme upheaval have used this portable asset successfully.[17]

In 2009 an exchange was launched by DODAQ to trade categories of polished diamonds. The DODAQ exchange is intended to be a terminal market for round, polished, certified diamonds (the most liquid part of the market) and hosts its centralised storage facility in a Freezone. The exchange is an attempt to overcome the traditional investment barriers of sales tax and low liquidity on the resale market.[citation needed]

In 2012 DODAQ nv and the Antwerp World Diamond Centre joined forces to create DIAMDAX. It is the first online diamond exchange to report the actual transaction price. The exchange provides its users with a fully automated trading platform and acts as counter party to both buyer and seller, offering anonymity to its users.[citation needed]

Rare “fancy colored diamonds” such as yellows, pinks, blues and greens have proved to be a secure investment over the five years preceding 2012.[18] This is based on the principles of supply and demand as well as new economies entering the market. Rio Tinto has announced that they intend to close the Argyle Mine in Western Australia in 2016–2018 which will impact the dwindling supply.

In its Global Diamond Report 2014, Bain & Co reports that demand for investment diamonds accounts for less than 5% of the total value of polished diamonds.[19] It also reports that diamond prices have benefited from 1.6x lower volatility than gold. Characteristics of investment-grade polished diamonds are highest color (D, E, F) and clarity (IF, VVS1, VVS2), weights ranging from 1 to 10 carats, triple-EX grading (Excellent Cut, Excellent Polish, Excellent Symmetry), and no fluorescence.

Investment Fund

In June 2012, Mr. Finanz Konzept AG launched the worldwide first actively managed physical diamond investment fund, which invests in natural diamonds.

Pure Funds launched an Exchange Traded Fund listed on the New York Stock Exchange in the November of 2012, investing in companies engaged in the diamond industry, rather than invest in physical diamonds. The fund has since ceased trading..

Mining companies

Mining companies produce and sell rough diamonds. Given the very high expense of operating a diamond mine, many diamond mining companies are public and/or owned by governments.[citation needed]

The largest diamond company in the world is Alrosa, which surpassed De Beers in carat production in 2008. De Beers is privately owned by Anglo American (85%) and the Botswana government (15%), so its shares are not traded on the stock market The Oppenheimer family had previously owned a 40% stake in De Beers, but this was sold to Anglo American in 2011. Rio Tinto and BHP[citation needed] are the next largest producers, but diamond mining is a small part of their commodity portfolio.

Recycled diamond, 2nd hand Diamonds

Diamond, because of its hardness, is one of the few gemstones that has a recycled market. Recycled diamonds are diamonds that have been polished and set into jewelry, then removed and possibly re-cut before sale back into the diamond industry. This sector accounts for 5%–10% of market supply.[30] Many jewelers typically offer to repurchase diamonds at a 15–20% discount relative to their selling price.

Whether it is releasing capital to re-invest in more liquid stock, or generating greater margin on re-purchased diamond jewelry, repurchasing diamonds is part of an ongoing strategy for many members of the jewelry industry. In 2012,

Tacy Ltd. stated that it expected $1 billion worth of recycled diamonds to be put back into the market.

The market

Diamonds of a certain size, generally half a carat and above, are traded and processed by the industry individually.

Each has unique attributes and a corresponding unique market place. Diamonds of this size, whether recycled or not, have a similar market price. It is impossible to tell the difference between a recycled one-carat diamond (as long as it is undamaged) and a “freshly mined” one-carat diamond with the same characteristics, and the market does not differentiate between them.[citation needed.

Diamonds of smaller sizes are traded in parcels of similar stones, called ‘melee’, after the French word for mix. Generally diamonds of exactly similar size, cut, shape, color and clarity are used in a single piece of diamond jewelry. If not, the stones would not match and the piece would not sell. Small recycled diamonds are treated differently from large individual stones.[citation needed] A single small diamond has limited value by itself. It is only of use if it can be matched with other similar diamonds, reset into jewelry and sold to a customer, thereby creating value. Small recycled diamonds need to be sorted, have their cut modified and resold to manufacturers in large parcels to allow them to pick matching stones to set in jewelry.

To explore partnership opportunities with NDC, contact industrypartner@naturaldiamonds.com

Looking to get into the diamond business, get a licence or invest in the rough diamond business, contact Evan Roberts through WhatApp +27739990999 / +351 912 194 833 or e-mail evan@evanaroberts.com